Mid-America Rural Development

Actively Sponsoring USCIS EB-5 Projects Across Rural Mid-America

USCIS-approved regional center sponsoring approved and pending EB-5 projects in energy, real estate, and infrastructure across nine states.

Mid-America Rural Development Regional Center

Approved by USCIS: September 13, 2023

Currently Sponsored Projects

Long Cove

Managing Partner - EB5 United

EB5 United - Long Cove: I-956F Approved

EB5 Energy

Managing Partner - EB5 Energy Holding

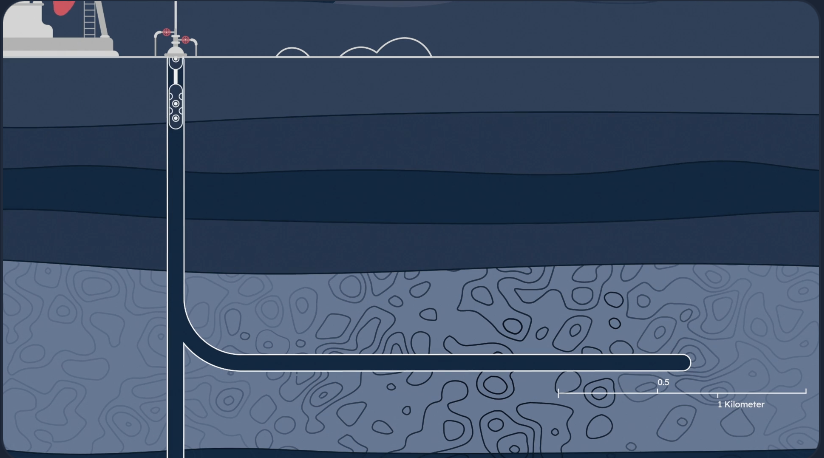

Anadarko Basin Oklahoma Oil & Gas: I-956F Approved

Some investors have received I-526E approval.

US Immigration Fund - Alpine 93/40: I-956F Pending

Luxury Lakefront Golf Community

Oil and natural gas re-completion of previously drilled vertical wells.

Alpine 93/40

Managing Partner: U.S. Immigration Fund

A Luxury Lakefront Golf Community near Dallas

Mixed-Use Development – Whitefish, MT

Who We Sponsor

Rural focused projects

Energy, Infrastructure, Commercial Real Estate

Issuers prepared for compliance scrutiny

What We Expect

Institutional quality documentation

Professional fund administration

Transparency with agents and investors

Expansive Rural Coverage

Our region includes some of the most rural states in the U.S., offering extensive eligibility for EB-5 investments, including faster adjudication and visa set-asides:

Texas:

83% of land is farmland, ranchland, or forest

Montana:

93 million acres, 62% agricultural use.

Oklahoma:

97% rural land area

Colorado:

30.2 million acres of farmland.

Wyoming:

97% rural by land area.

New Mexico:

Most couunties under 15 people per square mile.

Louisiana:

77% rural land area

North Dakota:

Predominantly rural with large agricultural zones.

Utah:

Majority rural in geography, despite uban population

Inside a USCIS Regional CenterAudit

MARD leadership has firsthand experience navigating USCIS audits and works proactively with issuers to maintain audit-ready operations.

Fee Structure

Setup Fee:

$35,000 - $45,000

Annual Fees:

$30,000 per year (minimum)

Partner with EB-5 professionals

Who We Are

Kurt Reuss is a registered broker-dealer representative and the President of Mid American Rural Development, a USCIS-designated regional center covering nine rural-focused states. With over a decade of experience in EB-5 securities and compliance, Kurt leads MARD’s efforts to support job-creating projects in underserved areas while ensuring regulatory integrity and investor protection. He is also the founder of EB5Marketplace, a platform dedicated to transparency and due diligence in EB-5 investing.

Kurt Reuss

President, Mid American Rural Development (MARD)

Mark is an experienced executive and coordinates the responsibilities for attracting good projects for Mid-America Rural Development Regional Center. He was Vice President of Operations for Greystone Oil & Gas, LP from 2010 to 2015 and helped start Greystone’s Devonian redevelopment program. He founded Blue Tip Energy Management in 2004, investing in underperforming natural gas assets.

Since 1998, Mark has been President of Wagner Energy Services, which designs and implements drilling and completion technologies worldwide. Mark holds a B.S. in Petroleum Engineering from the University of Missouri-Rolla and is a 35-year member of the Society of Petroleum Engineers.

Mark Wagner

Business Development